“The Winner’s Curse;” “Sunk Cost Fallacy;” and “The Endowment Effect.” Since the time of Adam Smith, the Science of Economics begins with the premise that economic man is a rational creature who makes rational decisions. But is this true?

- Do most people make rational decisions when it comes to money?

- More importantly, do you make rational decisions when it comes to money, and if not, should you?

- Finally, are there reliable experiments to help decide when to ‘trust your gut’ and when to slow down and apply rational thinking, experiments that will lead to more happiness, satisfaction and fulfillment?

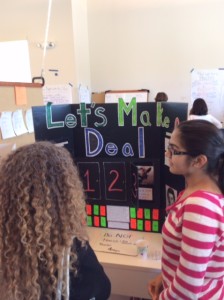

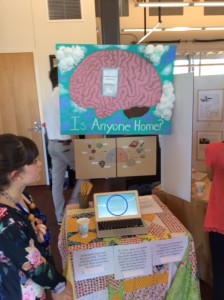

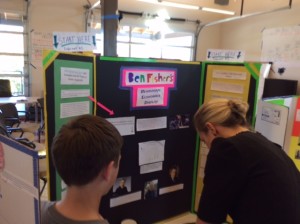

Last Thursday Middle School parents and guests toured many of the fifty Behavioral Economics experiments performed by Eagles. One guest bested the Wisdom of the Crowds, walking away with a giant glass jar of coins; another lost $26 trying to win a $20 bill at auction.

Following the Exhibition, a parent observed: “I graduated with honors in Economics from the University of Chicago, and I just learned more common sense lessons about money than in four years of college!”

An MS Eagle agreed: “The Biology Quest last spring was great fun. I learned a lot about plants, animals and evolution. But I’ve worked even harder on the Personal Finance Quest and Behavioral Economics Quest because I know they’ll help me more in life.”

At the end of the Exhibition, an Eagle offered one last bit of Type I and Type II advice: “Parents and guests – thank you for honoring us with your presence. May a gorilla never catch you unaware in the jungle; may you never be lured into a foolish auction and we hope “the wisdom of the middle school crowd” will help your intuitive and rational minds bring you all the happiness, satisfaction and fulfillment you deserve.”

Sound like Greek? Not if you are as well versed as the Eagles in Behavioral Economics.